- GoalTeller

- Posts

- Eq Exp of US Households I Defence ETF's I World Bank Survey I Investing Manual

Eq Exp of US Households I Defence ETF's I World Bank Survey I Investing Manual

Weekly Insights and Impact

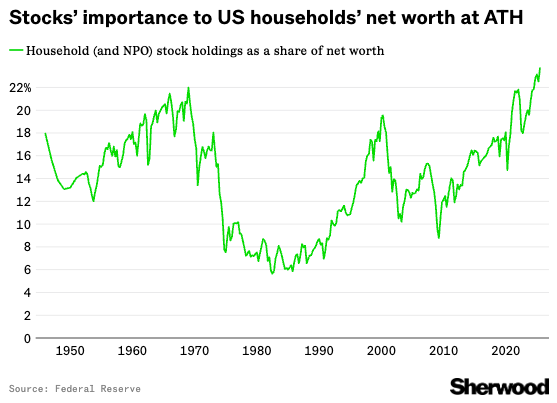

Allocation to stocks of total net worth in US Households

The bubble might get bigger, but the burst will be very very hard

Chart 2 - 5 year trailing returns are disconnected from long-term averages

• Markets moved higher and kind of broke a narrow zone after a long period on prospects of a US trade deal and softening stance by the US president.

• Tech stocks did well on the back of a buyback by Infosys and the surge in Oracle globally, which rubbed off on its Indian counterpart.

• Oracle Corp jumped 25% last week on big orders on cloud infrastructure backed by AI - again a reminder that the next few years will have pockets of big winners and some big poll losers as well.

• The markets have now started discounting the prospects of a softer or lower US tariff and an eventual trade deal - this should be the big trigger which could either lead the market to all-time highs or, conversely, back to sub 24,500 levels.

• Defence stocks did very well - look out for the chart below that shows how prominent international funds are making India a prominent part of defence allocations.

• As an investment strategy - if your view is short term, kindly stay away as both valuations and possibility of negative triggers persist - if your view and holding power is long term and can stomach a 20%-25% downside in your portfolio - DO NOT TRY AND TIME THE MARKET AS THE LONG TERM OPPORTUNITY CONTINUES TO BE STRONG AND BULLISH

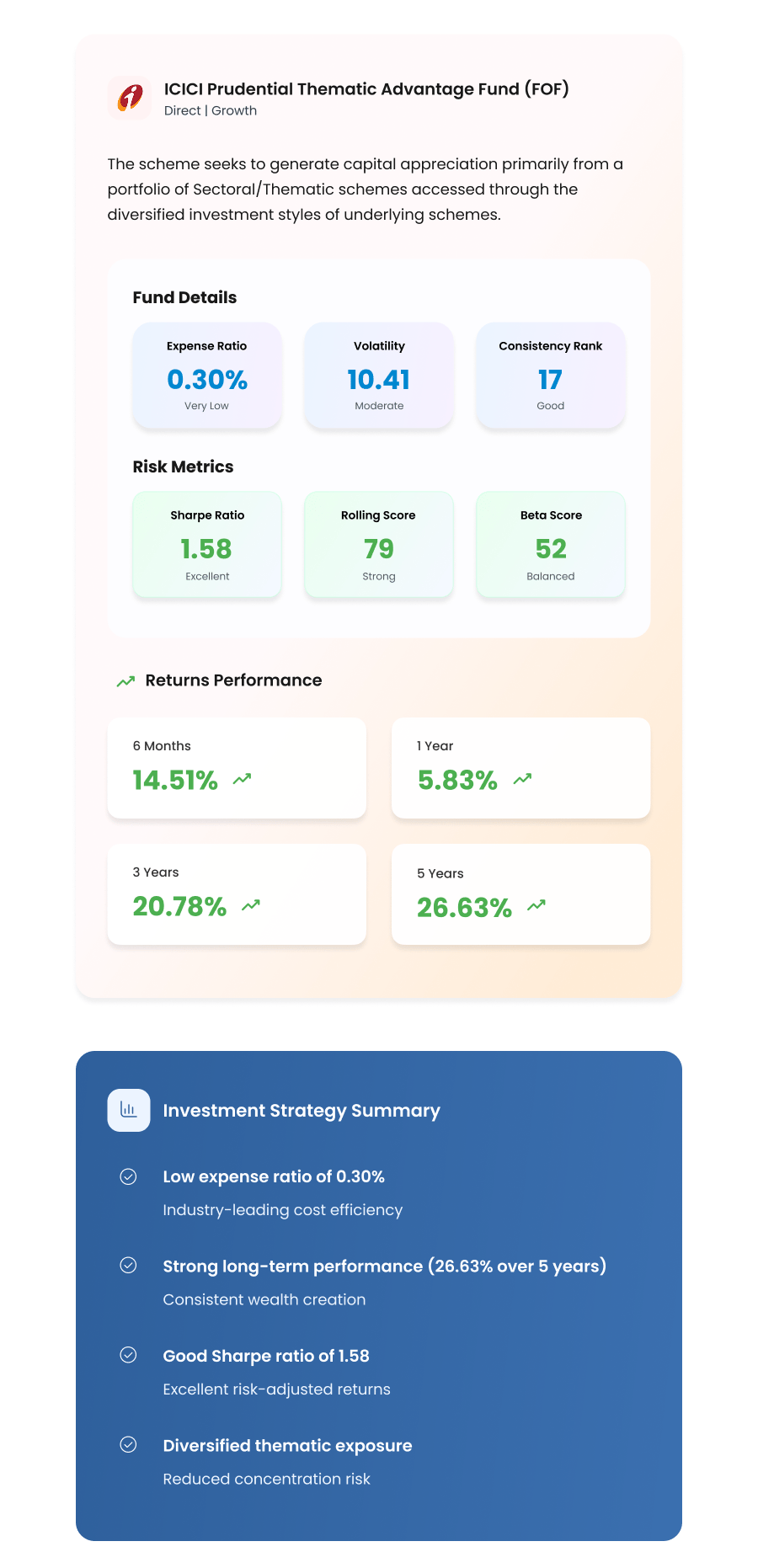

Here are some curated investment opportunities that align with your portfolio objectives. Each recommendation comes with a detailed analysis and risk assessment to help you make informed decisions.

Express your interest by replying to this email, or book a call by clicking below:

It’s a $128 billion fund

Defence ETF global allocations