- GoalTeller

- Posts

- Sensex at 1 lakh in 2 years (GoalTeller's note) I Why gold isn't a sub for Eq

Sensex at 1 lakh in 2 years (GoalTeller's note) I Why gold isn't a sub for Eq

Weekly Insights and Recap

In this newsletter we answer the million-dollar question –

What do we think of the markets and how to play it:

What percentage of your household savings are in equities? |

Summary of the Note:

→ Sensex headed for 1 lakh over the next 12-24 months

→ Nifty trading at historical average valuations (could go higher) while the Mid and Small Cap indices are trading way higher

→ Gold continues to be attractive as an asset class for the next 12 – 24 months

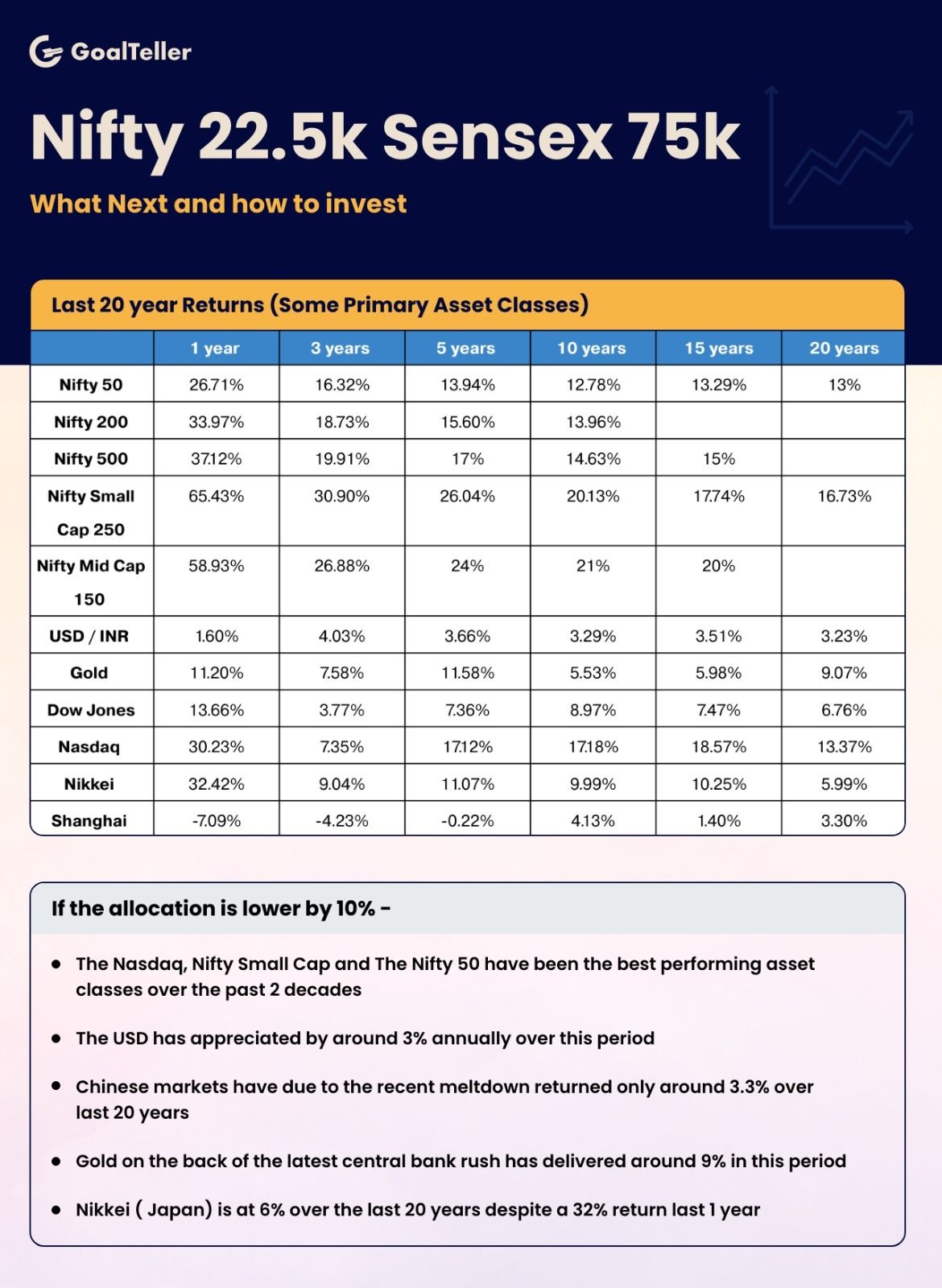

→ The Nifty Small Cap, Nasdaq and Nifty 50 have been the best performers over the past 20 years while China has been one of the worst

→ Household saving into eq should cross 10% by 2030 which will keep the domestic liquidity very strong

→ Big Risks - Major domestic political uncertainties, major credit defaults (domestic or globally) creating a cascading impact, escalating geopolitical tensions making oil go much beyond 110 and stay there

→ Existing Investors – stay invested as per your risk profile, rebalance mid and small caps to the target levels (lower in most cases)

→ New Investors – Deploy 50% immediately and rest 50% over a 3m (Large Caps) and 6m (Small and Mid Caps) of your desired allocation

Click below to read our whole analysis.

Worries about US growth coupled with high inflation led to a massive fall during the week in the US markets. However, stocks recovered well by Friday

Indian markets remained resilient despite the US growth data while mid and small caps continued to outperform

As the war worries ease out as we had suggested earlier, markets could move higher on the run up to the election outcome

Worries on low voter turnout for the ruling party is speculative and we believe even if so, the impact wouldn’t be meaningful to harm the prospects of a stable government

Read out detailed note on the markets outlook and investing strategies at these levels

Worries on stagflation in the US - Read More

Hedge funds lawsuits for stealing option trading strategies on Indian markets - Read More

Can India become a economic superpower - Read More

The central bank gold stampede - Read More

The death of the dollar - Read More

Muted growth in Indian IT sector - Read More

AI can kill all call centres - Read More

The men who killed Google - Read More

Like us to break down a specific finance story? Reply to us here.